YieldTopia

Yieldtopia is a dynamic ecosystem built on generic utility applications,

Yieldtopia Finance is designed to bring the benefits of cryptocurrency to society and how to get maximum profit by staking your assets. It is clear that the bank has deceived a lot of people who have deposited their money in hopes of making a big profit but sadly APY bank is a real scam and scam. Their APY is relatively small. Most of your prizes are claimed by the bank. For this course, Yieldtopia Finance comes with a solution to reward you when you use your crypto. The yieldtopia will start with a deflationary APY of 42.069% compared to 0.1% of the bank's APY. How this will be achieved is analyzed below.

Yieldtopia is a decentralized platform designed to be untrustworthy in the sense of not asking for trust from the Community as it is built on transparent and trustworthy technology. To appreciate this platform, we will cover the following:

• $yield token

• The mechanism behind $USDY

• Causes FUD in staking platforms

• Yieldtopia Finance Features

• Tokenomics

$YIELD TOKEN

$yield token is the native token of the Yieldtopia Finance ecosystem. It has various use cases like, staking/farming proceeds, DAO voting, providing Liquidity and exchanging it for other cryptocurrencies. It can also be borrowed or loaned. This is the main foundation of Yieldtopia. Finance

Our Vision and Mission

YieldTopia was created by crypto lovers and monetary specialists who understand financial matters, and accept that individuals should profit from their own money, not banks. We make it our primary goal to create a protected and managed convention that is productive for its financial backers.

$YIELD TOKEN INFORMATION

• Token Name: YIELDTOPIA

• Symbol: YIELD

• Decimal:18

• Token Type: BEP20

• Alamat Token: 0xA3a3D699B0a3a027d32C8d5040352ddE1b8A8106

• Total supply: 10,000,000,000 $YIELD

• Kode sumber kontrak pintar: https://addresscscan.com/addresscs 0xA3a3D699B0a3a027d32C8d5040352ddE1b8A8106#kode

MECHANISM BEHIND $USDY

$USDY is a decentralized stablecoin backed by a 1:1 BUSD IN ratio. Its uniqueness is defined by the following benefits.

Dex Liquidity Provider Rewards

Earn by lending

Scouting and farming

Referral gift

Hasil LabaTopia

.jpeg)

CAUSES OF FUD ON STAKING PLATFORM

It is important to know what happened to other platforms that once promised a high APY REBASE system, which then went bankrupt which resulted in losses on the part of investors. There are many platform designs with such promises but it becomes a big loss for investors who die because of their inability to live up to expectations. Let's take a look at the main causes of FUD and why investors' assets benefit. Many platforms with big promises don't have a Mechanism to keep their word. This has been a huge challenge, another reason being CEX's selfish interest to get rid of investors' assets.

EXCEPTIONALITY OF YIELDTOPIA.FINANCE

Yieldtopia.Finance is an excellent base on the mechanics of its design to deliver as promised. The number one thing in the protocol design is decentralization where the funds on the platform owned by the users are controlled directly by the users. This is not true with so many platforms and it is a major stumbling block before them. Another important tactic is the deflationary APY mechanism used to maintain the functionality and transparency of the ecosystem. It also incorporates many mechanisms to fulfill its objectives such as, token burning, Liquidity pool, Treasury funds.

TAX ALLOCATION

PURCHASE TAX: 9% is the tax levied on every purchase in the ecosystem and the tax is allocated as follows:

Liquidity Growth : 2% of each purchase is transferred to the Liquidity pool.

Capital Insurance Fund (CIF): 3% of each purchase is held in CIF

Treasury Fund: 3% of each purchase goes into the Treasury fund

Firepit (burn mechanism): 1% of each purchase is burned. This will help the price of the token keep the price going up.

13% SELLING TAX

Liquidity Growth: 3% of each sale is used for Liquidity growth.

Capital Insurance Fund (CIF): 5% of each purchase is held in CIF.

Treasury Funds: 4% of each purchase is kept in a Treasury fund.

Firepit (burning mechanism: 1% of every purchase will be burned in the firepit.

TOKEN ALLOCATION

Total supply: 10,000,000,000 $YIELD

20% (2,000,000,000) of total supply is allocated for Public presale

15.68%(1,568,000,000) of total supply allocated to Liquid

20% (2,000,000,000) of the total supply is allocated to the Treasury Fund (DAO)

5% (500,000,000) of total supply is allocated for Marketing Budget

4.92% (492,000,000) of total supply is allocated for Initial Marketing Budget, CEX, Others

5% (500,000,000 ) Tokens of total supply allocated to Team

9% (900,000,000) Capital Insurance Fund (CIF)

5% (500,000,000 ) of total supply allocated to Firepit (burn)

15% (1,500,000,000) of the total supply is allocated to Initial.

TAX ALLOCATION

PURCHASE TAX: 9% is the tax levied on every purchase in the ecosystem and the tax is allocated as follows:

Liquidity Growth : 2% of each purchase is transferred to the Liquidity pool.

Capital Insurance Fund (CIF): 3% of each purchase is held in CIF

Treasury Fund: 3% of each purchase goes into the Treasury fund

Firepit (burn mechanism): 1% of each purchase is burned. This will help the price of the token keep the price going up.

13% SELLING TAX

Liquidity Growth: 3% of each sale is used for Liquidity growth.

Capital Insurance Fund (CIF): 5% of each purchase is held in CIF.

Treasury Funds: 4% of each purchase is kept in a Treasury fund.

Firepit (burning mechanism: 1% of every purchase will be burned in the firepit.

Membership Benefits

- Early acceptance to Beta apps

- Initial acceptance to $USDY stablecoin and $YIELD token

- Useful airdrop for YieldTopian Membership Card holders

- NFT results: NO stage fees when trading NFT

- Exchange Results: NO stage fees when trading tokens via YieldSwap

- YieldPad: NO stage fee when taking part in pre-bid

Administration: The power of dual democracy

- Marking and Farming Pools: Access to individuals who only mark and cultivate pools

- Unique VIP title on YieldTopia talk (Telegram and Discord)

Yieldtopia Finance is the best platform to invest your funds and rest assured because of its decentralized infrastructure. Unlike other promising platforms that can't deliver on their promises. Yieldtopia is made up of a team of experts who have studied the reasons why other Platforms fail. After studying other people's pitfalls, they have built a sustainable and scalable platform.

$YIELD is YieldTopia's local token and the main token used in the entire biological system. The YieldTopia utilities are all centered around helping $YIELD and its holders. The outstanding yield convention known to YieldTopia expects financial backers to engage $YIELD to take part in tagging and processing pools, and creates a high deflationary APY prize awarded in $YIELD. Furthermore, $YIELD can be used for borrowing and receiving, voting administration, providing liquidity, trading between well-known digital currencies, and procuring some of YieldTopia's profits by simply holding $YIELD.

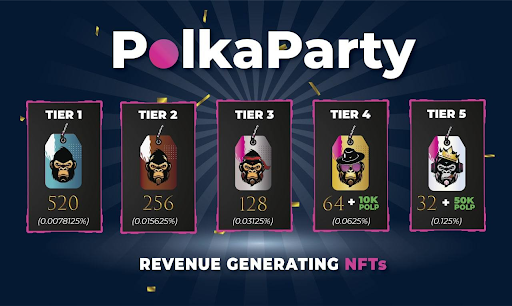

NFTNFT Results

is an open marketplace that allows clients to view, view, buy or sell their NFTs and NFT Collections. The commercial center supports the accompanying blockchains: Binance Smart Chain, Ethereum, Avalanche, Polygon. What makes YieldNFTs special is their extremely low stage fee in testing with other commercial NFT centers, even offering some well-known variations such as BoredApeYachtClub's 0% stage fee. YieldTopian Membership Cardholders will not be charged any stage fees

YieldNFTs (Pasar NFT): https://YieldNFTs.finance

Swap

YieldTopia's Swap is a tokenized decentralized trading provided by YieldTopia. All stage fees collected are sent from the YieldTopia liquidity pool, hedge assets and storage reserves, providing extra support to the $YIELD token. YieldTopian Membership Cardholders will not be charged any stage fees.

YieldSwap (DEX): https://YieldSwap.finance

Rebase APY

Programmed Rebase, Deflationary APY, Auto-Compounding:

YieldTopia awards deflationary APY holders starting at 42.069% Annual Percentage Yield. A lot of capabilities are at work related to making this maintainable (as referenced on the presentation page). This is achieved with modern Rebase Mechanisms. All symbolic holders get rewards, periodically, and this combines elements of auto-tagging and auto-intensification. APY goes through a deflationary cycle known as splitting, periodically APY will decrease by 10% from before, giving the convention extra manageability.

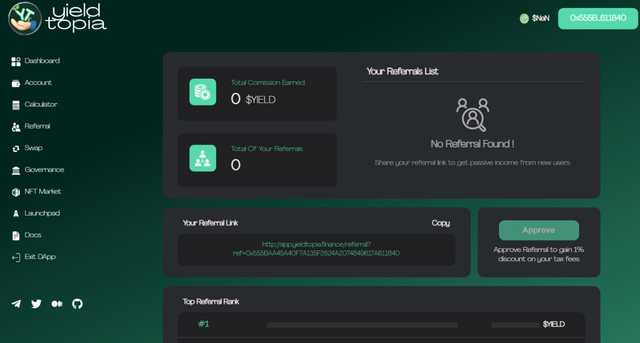

Program Reference Program

referrals is YieldTopia's method of motivating local people to spread the word more about the environment. For each useful referral, you will get 1.5% of your referral's exchange rate, and they will get a 0.5% price reduction in the long term of their exchange fee. To get your own external reference: http://app.yieldtopia.finance/reference

Presale July 14–16 https://www.pinksale.finance/platform/0x06992e197aE564C82B4Db229A1ab0361A17B5519?chain=BSC <- — Presale link. Delivery on July 18th at 19:00 (UTC).

We would like to state that the $YIELD presale will be publicly accessible via PinkSale. The module we decided to use was classified as "fair shipping" and that implies that all members can buy as much $YIELD as they need at the same cost during the presale stage. Based on our team's testing, the fair delivery module is much better for the business lifetime and for the most part makes upfront financial backers great returns compared to the normal pre-sales module.

TOKENOMIC

Token Name: YieldTopia

Simbol Token: YIELD

Decimal Token : 18

Jaringan : Binance Smart Chain

Cross-Chain via: Ethereum, Polygon, Cronos, Optimism, Arbiter, Fantom, Avalanche, BSC.

Alamat Token : 0xA3a3D699B0a3a027d32C8d5040352ddE1b8A810

Total Supply: 100,000,000,000 $YIELD

Locked Liquidity : Yes — 5 Year Locked Liquidity Pool.

BSCScan : https://bscscan.com/address/0xA3a3D699B0a3a027d32C8d5040352ddE1b8A8106#code

token allocation:

Public sale 20% (2,000,000,000) lock/vesting : Yes — in PinkSale contract

Liquidity Pool15.68%(1,568,000,000)lock/vesting : Yes — LP Lock 5 Years (locked via PinkSale)

Treasury Fund (DAO) 20%: 2,000,000,000 locking/vesting: Yes - 2 -year locking with 5% release every 6 months. (locked via PinkLock)

Marketing 5%: 500,000,000 locks/vesting: Yes- Lock 8 months, with 1% release after 30 days, 2% after 4 months, 2% after 8 months. (locked via PinkSale)

Initial Marketing Budget, CEX, Others 4.92%: 492,000,000 keys/vesting : No- This is the initial budget to start the project, this token will be used (not sold) to provide liquidity on other chain DEX, centralized exchange, airdrop, KOL, marketing efforts, etc

Capital Insurance Fund (CIF) 9%: 900,000,000 lockout/vesting : Yes- 2 year lockout with 3% release after 12 months, 3% after 18 months, 3% after 25 months. (locked via PinkSale)

Firepit (burn) 5%: 500,000,000 lock/vesting : Yes- locked for 13 months, upon release all tokens will be burned and removed from circulating supply. (locked via PinkSale)

Team Token 5%: 500,000,000 lock/vesting : Yes- 1 year lock with 10% released on TGE, and 8% a month after. (given through PinkSale)

Initial Burn 15%: 1,500,000,000 lock/vesting : Burned & removed from circulating supply. (burnTxhash 1, txhash 2, txhash 3)

Presale $YIELD

$YIELD Presale runs from 14–16 july 2022 and launches on 18 july 2022 (7.00PM UTC)

Pre-sale Type

Fairlaunch - Open To The Public

Pre-sale Contract Address : 0x06992e197aE564C82B4Db229A1ab0361A17B5519

Alamat Kontrak Token : 0xA3a3D699B0a3a027d32C8d5040352ddE1b8A8106

Min/Max purchase per person: unlimited

Total supply : 10,000,000,000 $YIELD

Locked Liquidity Pool : Yes- 5 year Locked Liquidity Pool Locked with PinkSale

Token For Presale: 20% Supply: 2,000,000,000 $YIELD

Token For Liquidity : 15.68% Supply: 1,568,000,000 $YIELD

Presale starts July 2:7PM (UTC)

Presale ends: July 16: 7PM (UTC)

DEX launched : July 18:7PM (UTC)

Liquidity Percentage : 80%

.jpeg)

YieldTopia rewards its holders with a deflationary APY starting at 42.069% Annual Yield Percentage. The various functions work together to make this sustainable (as mentioned on the introductory page). This is achieved with an advanced Rebase Mechanism. All token holders receive rewards, every 30 minutes, and that includes auto-staking & auto-compounding features. APY goes through a deflationary process known as halving, every 30 days the APY will be reduced by 10% from before, providing additional sustainability to the protocol. As you probably already know, new crypto assets, especially during their early stages can be very beneficial to early adopters, but may be subject to “pump and dump” by bots or malicious traders. YieldTopia has the solution for that, the team created the best protection against pump-n-dumps, protect all YieldTopias and their investments. There is an anti-dump system that is hard-coded into the source code of the $YIELD contract, where the holder can sell between 5% — and — 20% per day. The sales allowance is determined based on the token trading volume at any given moment. Wallet-to-wallet transfers are disabled in the $YIELD contract to prevent traders from bypassing the ADP system. The community can customize % by proposing new options via the Governance dashboard. Wallet-to-wallet transfers are disabled in the $YIELD contract to prevent traders from bypassing the ADP system. The community can customize % by proposing new options via the Governance dashboard. Wallet-to-wallet transfers are disabled in the $YIELD contract to prevent traders from bypassing the ADP system.

Detailed Information:

WEBSITE: https://yieldtopia.finance/

WHITEPAPER : https://docs.yieldtopia.finance/

TELEGRAM : https://t.me/yieldtopiachat

TWITTER : https://twitter.com/YieldTopia

MEDIUM : https:// medium.com/@YieldTopia

INSTAGRAM : https://instagram.com/YieldTopia

Comments

Post a Comment