Rain.Credit

Rain.Credit

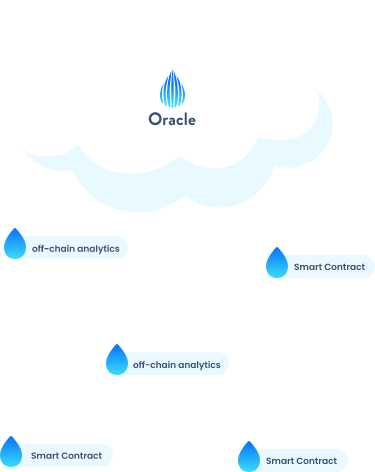

Agregasi Oracle Analytics Off-Chain

With the growth and development of the Crypto or blockchain ecosystem, a number of alternative investment options have emerged, and have proven to be more efficient and profitable investment tools than traditional financial returns. Innovative projects consistently appear in the crypto industry with high return investments and a continuous trend, because Albetrage is one of those projects that will attract large market investments. Why? Because this project aims to create a safe and decentralized working model. Rain.Credit is the project you've been waiting for ……

RAIN.CREDIT DeFi

Ii is a BEP20 token on the Binance Smart Chain that acts as an Oracle Aggregator non-custodial Off-Chain Data analyzer that assigns a short Credit rating to the user's address. This credit rating serves to provide a good collateral factor for all lenders and is also useful for digital asset borrowers on the rain platform. rain.Credit is based on current decentralized lending platforms and protocols, but with ways to deliver more innovative designs and experiences.

What makes us unique is how we will use Off-Chain Aggregate analysis to help reduce the exposure of investors as they begin to interact with our ecosystem. # RainCredit #Blockchain #cryptocurrency and #BNB

Oracle Analytics Feed On-chain Off-Chain Protocol.

Previous migration flights via DeFi are stored in your Ethereum address history. Rain.Credit's off-chain oracle analysis accesses that history to provide the loan platform with more information about loan applicants to reduce the risk of default.

The more information and history the loan applicant finds, the following collateral is needed to borrow, which can maximize the funds available for access.

Some examples of real-world events that can affect access to on-chain loans and increase the risk of default include, but are not limited to:

Customer account activity

Payment history

New government policy

Borrow More Assets With Existing Collateral

Rain Loans is a non-custodial digital asset lending and lending platform. It is based on a combined protocol with a modified asset pool and the use of Rain + to increase access to additional funds on top of the current secured debt position (CDP) offered by Compound Finance, AAVE & CREAM.

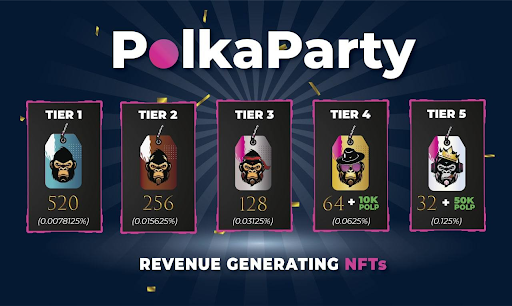

Rain + is an additional amount of tokens that we offer to borrowers through our platform by providing additional guarantees, based on their transaction history and ratings from Rain Off-Chain forecast analytics.

What makes Rain.Credit so unique?

What makes us unique is how we will use Aggregate Off-Chain analytics to help reduce investor exposure as they start interacting with our ecosystem.

The way our ecosystem benefits from this innovation is very simple. A user who trusts as much information as possible considering his transaction history across multiple chains, will need less assurance than a user with an unclear transaction history. This provides a transparent view for other lenders or borrowers which in turn creates a safer ecosystem. Users providing this information will also have additional access to $ RAIN tokens available to borrowers without the need for additional collateral. The number of tokens a borrower can receive is based on the user's Aggregate transaction history of the rating values obtained by Oracle Off-Chain Analytics. The formula for determining the amount of $ RAIN tokens to be lent is as follows:

RAIN = Amount to borrow + Transaction History / Safe amount

Off-Chain API interfaces for third party integration with enterprises, protocols, developers and other deFi applications will be provided. Some of the key features available include multiple POST and GET endpoints for multiple Layer 1 and Layer 2 Ethereum chains. Over time other features will be introduced, some of these features are: Integration with external data providers and directories, decentralized account blacklist tracker , smart contract analysis, and off-chain measurement of equity and assets, loan aggregation engine, Shared AMM across multiple chains, Investment Intelligence and more will be released in the future and will be free for members of the $ RAIN community.

Oracles provide solutions to transparency problems that many projects may face. By taking information off-chain and supplying data in an unchanging manner, Rain.Credit Oracle enables smart contracts to pull data from blocks that enter the required information. The information that Rain.Credit forecasts sends will include things that the blockchain cannot track or monitor. This includes payment history of users across multiple chains, real world economic events, government policy changes, and user account history.

By providing a completely transparent layer, trust is imparted by lenders and borrowers. Given blindly lending multiple crypto assets with any kind of historical proof of previous fulfillment of loan terms, lenders can enter into the user's payment history with other loan protocols required dynamically and determine the amount required by the lender. . These are all loan protocols to have better control on asset allocation to specific users depending on their credit score. Other external factors may also influence this trust, but it is not possible with the information provided by Rain.Credit Oracle.

By taking advantage of the Collateral Payable Position used by Compound, Aave, Cream and other providers who also combine assets collected through our AMM. Users will have a different experience that is not the case with other loan providers. With $ RAIN, you can borrow up to 70% of your collateral (for example you can borrow 70 BNB and the equivalent in BUSD, DAI, or any other stable coin posted with a 100 BNB guarantee).

Users who get the additional $ RAIN tokens borrowed will be charged additional interest and must meet the payment on time. If the user is unable to meet the repayment agreement before the liquidation occurs, the user will be subject to a positive analytics rating that will reduce their chances of being granted another loan on the platform.

Tim

Rainbuilder / Main Developer

Blockchain engineer, researcher, developer with over 10 years of combined experience in the fintech, machine learning, data processing science, and blockchain industries.

City / Developer

Full stack engineer with more than 5 years experience in the blockchain industry. He is also very fluent in Rust, Python and Golang.

Drizzle / Community Manager

More than 3 years experience in crypto, 5 years in customer relations, public relations and presentation skills, excellent interpersonal and relationship skills

Monsoon / UI / UX Designer

Enthusiasts of decentralized technology. Love good design, technology and innovation.

Company official website ; https://rain.credit/

Telegram;https://www.linkedin.com/embeds/publishingEmbed.html?articleId=7748429341555344578

GutHubhttps://www.linkedin.com/embeds/publishingEmbed.html?articleId=7770637248743708540

Mediumhttps://www.linkedin.com/embeds/publishingEmbed.html?articleId=7716793857613787740

Twitter https://twitter.com/rain_credit

Perselisihanhttps://www.linkedin.com/embeds/publishingEmbed.html?articleId=8269280075280677695

by ; Mbelitar

link: : https://bitcointalk.org/index.php?action=profile;u=3198654

Comments

Post a Comment