Metavault.Trade

Metavault.Trade: Next generation DEX perp with zero slippage swap and leverage up to 30x

Decentralized Exchange:

I think all of my readers understand what holds the exchange together. This is a demonstration of buying/selling resources on Integrated Trading (CEX) such as Binance, KuCoin or Coinbase. These stages have both advantages and disadvantages: they can offer low exchange fees and consider a lot of adaptability via APIs and bots. After all, they also require varying degrees of KYC to use—which is basically something to be grateful for, until they're hacked and your own information is available for use by every possible troublemaker—and in some cases they freeze your resources for reasons only known to them. Worst situation imaginable they are hacked and you lose everything you have in their foundation. "Not your key,

Metavault.Trade is an exchange platform that provides decentralized crypto exchange services designed with various crypto features. Metavault.Trade provides spot & perpetual exchange services that allow users to trade with up to 30x leverage and directly from their personal wallet.

Metavault.Trade is an innovative decentralized exchange platform as it provides spot & perpetual exchange services where users can trade safely and easily without going through an account, but simply by connecting their wallet and they will be able to trade. So it is a decentralized crypto exchange platform with leverage and convenience for users.

Metavault Purpose

Metavault.Trade aims to be the go-to solution for traders who want to stay in control of their funds at all times without sharing their personal data. Its innovative design gives it many advantages over other existing DEXs

Traders can use it in two ways:

Spot trading, with swap and limit orders.

Perpetual futures trading with up to 30x leverage on short and long positions.

Decentralized Applications (dApps) address some of these problems by moving exchanges to blockchains such as Ethereum and offering decentralized exchange setups. Uniswap is probably the most popular Decentralized Trade (DEX). No KYC required, and you can use it from anywhere on the planet. However, the fees on Ethereum can be 10 to several times higher than anything they would be for a comparative exchange on CEX, especially for those with simpler position sizes. High decentralization costs! Metavault.Trade is another age DEX that brings a lot of development and very low fees.

Problem

Most of today's crypto users trade through centralized exchange platforms. Through this exchange platform, users will be able to trade crypto easily and securely. But the problem is that usually centralized exchange platforms use KYC for their trading which is problematic for some as it is related to their identity and privacy. Whereas users should be facilitated with a crypto trading platform that will make it easier for them to trade and not ask for their identity so that users will be able to trade freely without worrying about their privacy.

The solution

And in response to this issue, Metavault.Trade was launched as a decentralized exchange platform that would not question the identity of its users. This service is provided by Metavault.Trade is a decentralized & perpetual exchange, which will allow users to trade quickly and securely with leverage through their personal wallets. Since it only requires a connection to the user's digital wallet, it means that Metavault.Trade does not require the creation of an account for the user. Users will be able to trade their favorite pairs freely without worrying about their privacy.

Metavault Exchange Features

Low Fees - Very low transaction fees.

No price influence, even for large order sizes.

Simple Swap - Open positions via a simple swap interface. Easily swap from any supported asset to your preferred position.

Reduced Liquidation Risk - Protection against liquidation events: sudden price changes that often occur in a single exchange (“scam wicks”) are smoothed out by the design of the price mechanism.

Complete platform: spot trading and leverage.

Multi-asset pools - The key innovation at the heart of Metavault.Trade is multi-asset pools. This feature allows the platform to share liquidity across all the assets it supports.

Metavault.Trade . Ecosystem

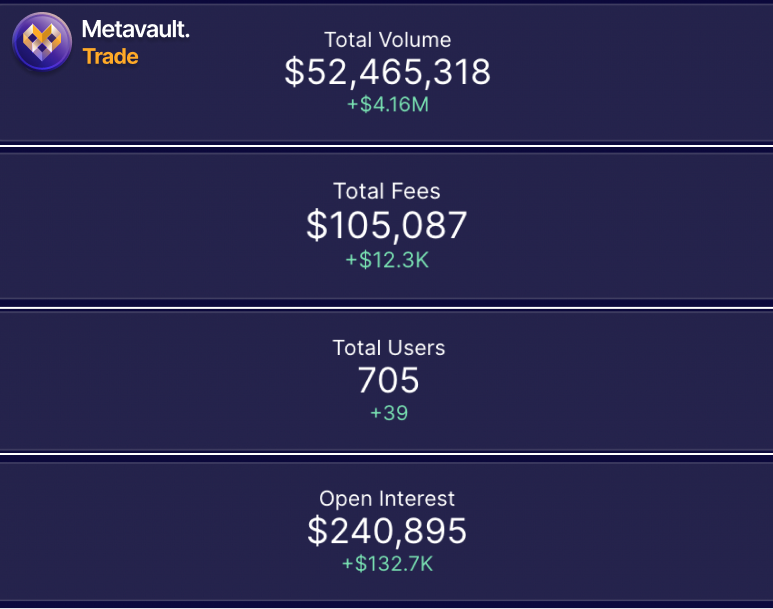

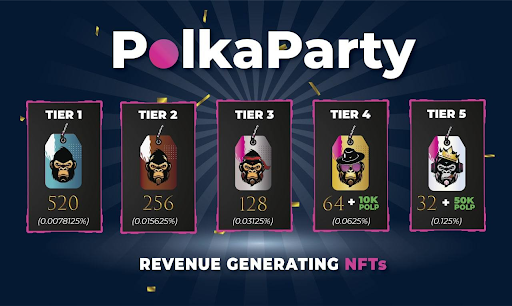

MVLP ( Liquidity Provision Incentive) - MVLP is a liquidity token platform. Metavault.Trade requires a multi-asset pool with a lot of liquidity. To ensure this happens, the platform has a very generous incentive program: 70% of the platform fees are redistributed to liquidity providers who score MVLP by accumulating their crypto assets. MVLP acts as a counterweight to leverage traders on the platform, with their losses flowing back into MVLP.

MVX - Metavault.Trade has its own governance and utility token: MVX. Holders are incentivized to stick around for the long term, with many rewards accumulating quickly. MVX marketers will get 30% of the fees collected by the platform in the form of the network's native token — MATIC on Polygon.

Metavault.Trade is a new type of Decentralized Exchange, designed to provide a wide range of trading features and very deep liquidity on many large cap crypto assets.

Traders can use it in two ways:

Spot trading with swap and limit orders.

Trade Perpetual Futures with up to 30x leverage on short and long positions.

Metavault.Trade aims to be the go-to solution for traders who want to stay in control of their funds at all times without sharing their personal data. Its innovative design provides many advantages over other existing DEXs:

Very low transaction fees.

No price impact, even for large order sizes.

Protection against liquidation events: sudden price changes that often occur within a single exchange (“scam wicks”) are smoothed by the design of a pricing mechanism that relies on Chainlink price feeds. All-in-one platform: Spot and Leverage trading.

Buy and sell

Metavault.Trade is a state-of-the-art Decentralized Exchange platform that does not require registration. To start trading on Metavault.Trade all you need is a Web3 wallet.

Lead contract:

When people start swapping, they usually start with a "spot swap", which consists of trading directly available resources. After all, there are also more modern instruments called prospect agreements, or "fate" for short:

A contract of destiny is an agreement to trade a product, money or one more instrument at a predetermined cost at a predetermined time from now on.

Not at all like the regular spot market, in the prospect market, the exchange is not 'finished' in an instant. All things being equal, the two partners will exchange an agreement, which characterizes the sometimes not-so-distant settlement. Likewise, destiny markets do not allow clients to buy or sell computerized goods or resources directly. All things considered, they're exchanging agreement pictures about it, and the genuine exchange of resources (or money) will take place from now on — when deals are put into practice [Ref].

This agreement is meant for one to be able to support against this type of market, but fate swaps also offer more potential payoffs than spot exchanges:

Traders can "sell": they can bet against the resource without claiming it.

Traders can take advantage of leverage: they can enter positions for their various balances. In doing so, however, they run the risk of losing their entire balance when the market goes in the wrong direction, regardless of whether just a little. Using high leverage (10x, 20x… 100x!) with large positions is extremely dangerous and should be strictly avoided if you are not an expert broker!

The great innovation at the heart of GMX, and now Metavault.Trade, is the Multi-Asset pool. All assets supported by the platform are pooled together and a token called MVLP represents the index of this token. The price of the MVLP will fluctuate with the price of the underlying asset in the basket and the traders' Profit and Loss (PnL) — when they lose a trade, their losses flow to the MVLP.

How does this shared liquidity lead to a lower price impact exchange solution? Say for example that the pool consists of five assets (BTC, ETH, MATIC, USDC and DAI) in equal proportions in terms of dollar value: 20% each. If a trader wants to buy 50% of the supply of BTC with USDC, they can do so instantly, without any price impact. Once the order is completed, the pool status will be BTC: 10%, USDC: 30% and the rest remains unchanged. To understand how unique this feature is, I encourage you to check out how much price impact you can get for very large orders on CEX with an order book or on a DEX like Uniswap!

Metavault.Trade is built by professionals and experts in their field who have years of experience in blockchain technology and understand the crypto market. The team is collaborating together on developing a decentralized exchange that will be used by many people globally easily and securely. With this collaboration, it is hoped that users can get the best service, where they can transact safely, quickly, and at lower costs through their devices.

Conclusion

Metavault.Trade is one of the best projects I've seen so far. This project precedes the others. Since everything in this project is very clear, it can be said that the future of this project is very bright. Hopefully investors will benefit when investing in the project. Since this project is going according to plan so far, I think this project will be much better. Because yes, but most of these big investors have invested in the project. I think the future of this project is bright.

Link

Social media

Website: https://metavault.trade

Telegram: https://t.me/MetavaultTrade

Twitter: https://twitter.com/MetavaultTRADE

Media: https://medium.com/@metavault

Discord: https://discord.gg/metavault

Documents/Code

Github: https://github.com/metavaultorg

Docs: https://docs.metavault.trade

by ; cuppaca link: : https://bitcointalk.org/index.php?action=profile;u=2648951

Comments

Post a Comment